Land of golden promise: the China whisky boom

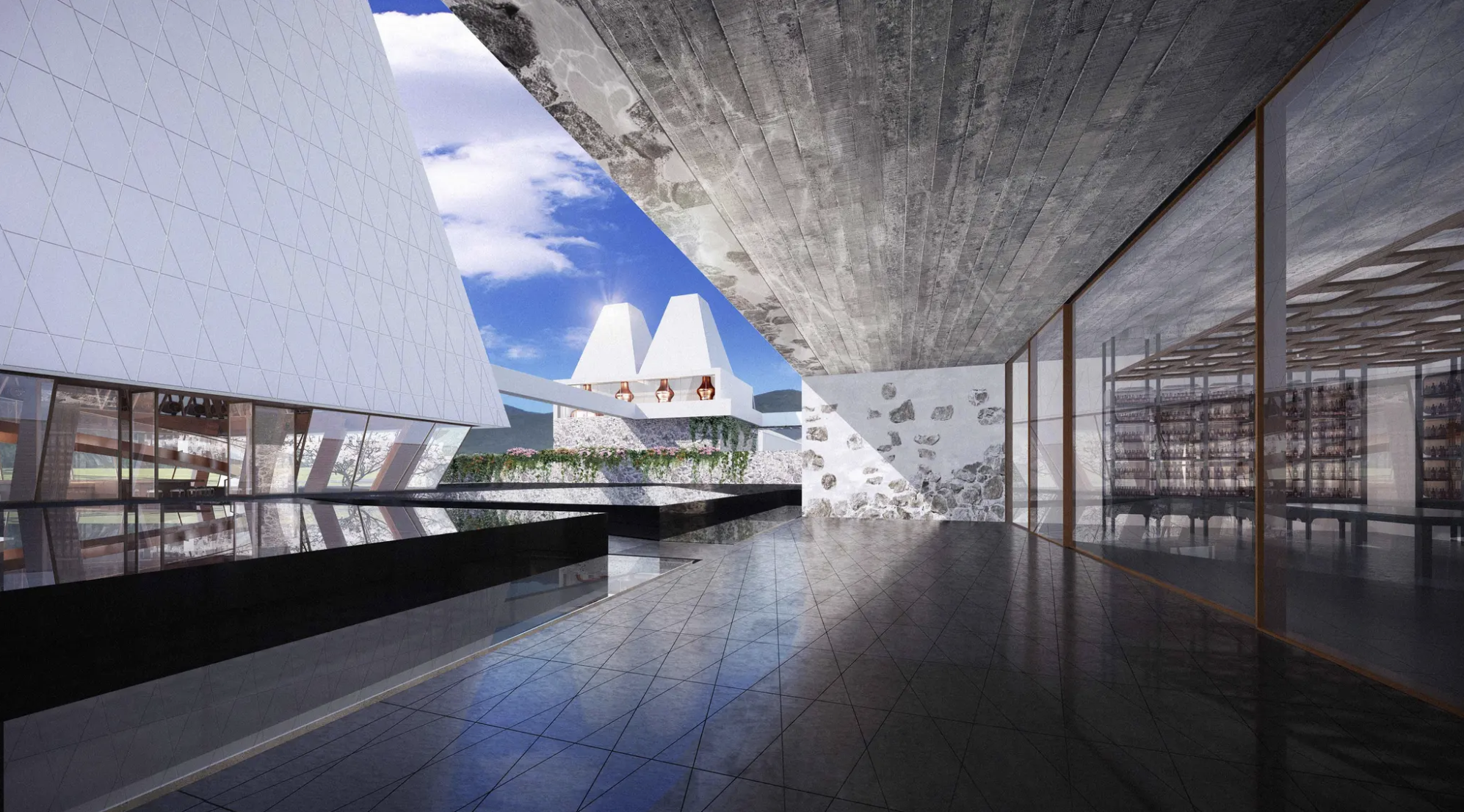

Diageo’s spectacular Eryuan Distillery in China

A rapidly growing demand for whisky in China, primarily among the young, has seen exports rise substantially and the industry’s biggest players move in with serious intent. And they’re not just looking to bolster their selling power to China, reports Tom Pattinson, they’re locked in a dramatic battle to create the first Chinese whisky…

Chivas paves the way for a whisky revolution

The heavy bass of the music bounces off the walls of the club, arms wave in the air, and waiters deftly dart around the cavernous night club, buckets of ice packed with bottles carried over their heads. They bring trays of glasses to VIP tables where jugs of chilled green tea are used as mixers for the bottles of Chivas Regal whisky that are dotted on nearly every table. In one of the many VIP rooms, I sit on a sofa and watch as a bottle of Chivas so big that it has to be lifted by a pulley system, fills jugs mixed with green tea over ice.

It’s 2006, Beijing, and I’m in Mix, one of a number of huge nightclubs where the newly emerging middle class are coming to let their hair down, dance to techno and show off their new found wealth. They are doing this by buying enormous quantities of a new Western drink – whisky.

When I first landed in China, I thought Chivas Regal was a chain of nightclubs, such was the vast amount of branding inside and outside nearly every nightclub in the country in those heady days.

In the first decade of the 21st century, all kinds of brands were trying to crack the lucrative China market and spirits brands were no exception. But Pernod Ricard had decided to push Chivas Regal, which they purchased in 2001, hard into the market and for a few years at the end of that decade ‘Chivas and Green Tea’ was the go-to drink for clubbers around the country. It revived the Chivas brand, increased Pernod Ricard’s revenues significantly and helped introduce whisky to a market entirely dominated by the white spirit baijiu that makes up the vast majority of the country’s spirit marketplace.

‘When I first landed in China, I thought Chivas Regal was a chain of nightclubs, such was the vast amount of branding inside and outside nearly every nightclub in the country in those heady days’

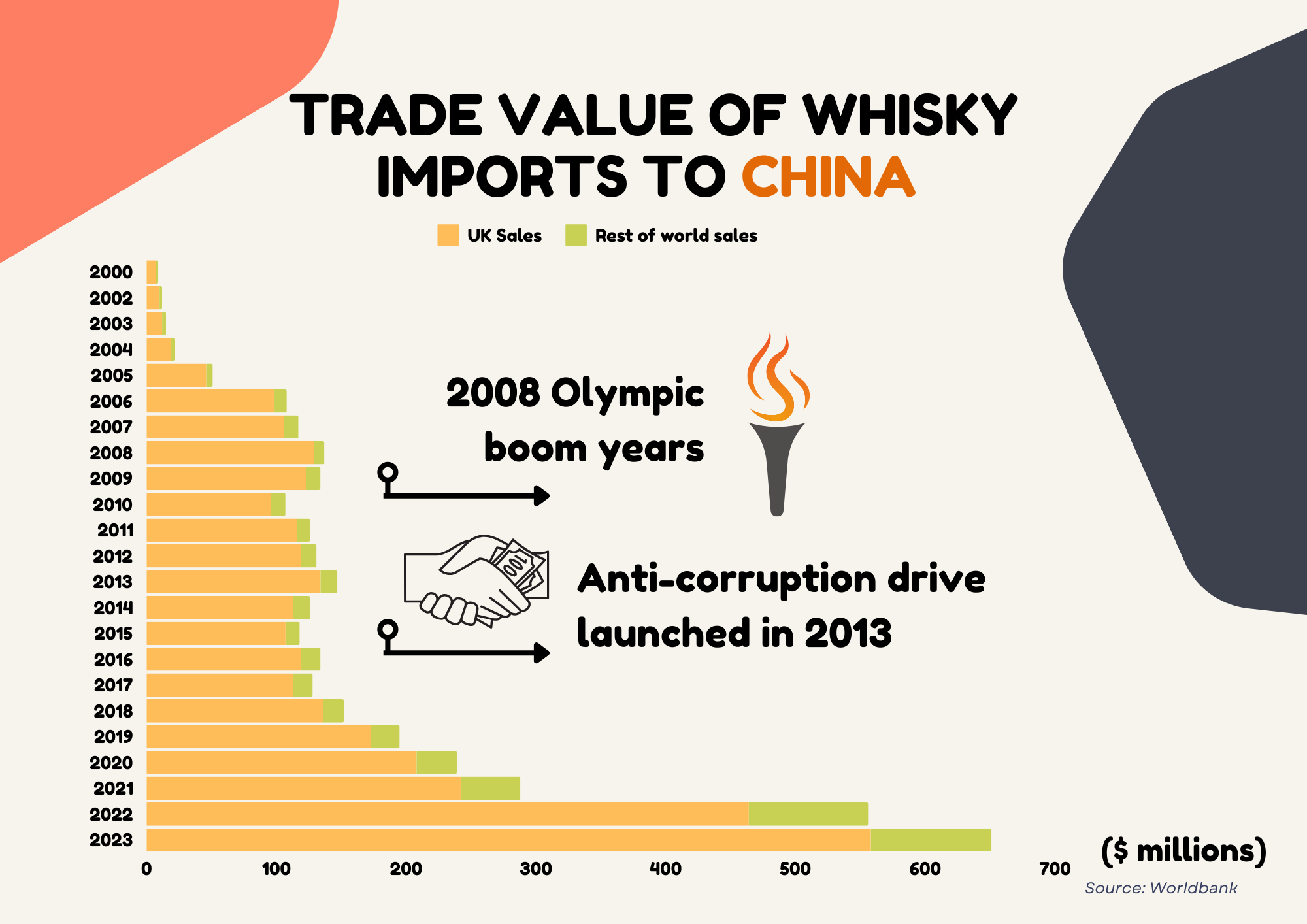

That year, 2006, China leapt into the top 10 whisky drinking countries for the first time ever, in no small part thanks to Pernod Ricard’s sustained drive that involved not just sponsoring clubs but fashion shows, international DJs and even opening their own bar. In 2006, £90 million was spent on whisky in China, according to Euromonitor. Today it has increased ten-fold, with the value of whisky sales in China reaching nearly a billion pounds.

Growth and expansion: The Chinese whisky market gains influence

China’s national spirit, baijiu – a strong pungent white liquor made from sorghum that is toasted at banquets, weddings and business meetings – makes up around 96% of the spirits market in China. Whisky absorbs just 1%, with brandy being the dominant imported spirit and vodkas, gins and rums comprising the rest.

Still, a single percent of China’s staggering £120 billion annual spirits sales amounts to a big chunk of revenue. China became the world’s fourth largest whisky market by value in 2023 – up from sixth in 2022. And according to Euromonitor International, China’s whisky sales are expected to double from £920 million in 2023, to £1.8 billion by the end of 2025, which will make China’s whisky market greater than Germany’s. That figure is expected to almost triple by 2027. Euromonitor predicts whisky – including Scotch whisky – will be the fastest-growing spirit in China in the coming years, booming by 88% between 2023-2026, and the whisky market in China is expected to grow at around five times the rate seen globally.

The Asia-Pacific region overtook the EU in 2022 in Scotch whisky sales, to become the industry’s largest market, and global exports of Scotch whisky rose a whopping 37% in 2022 according to the SWA – in no small part due to double digit growth from China.

For brands, China is becoming increasingly important. China is now Pernod Ricard’s second largest market globally and businesses, both international and domestic, are fully aware that there’s a lot of room for further growth.

The rise of the single malt aficionado: A snapshot of the Chinese whisky drinker

Kelvin Tam, the Scotch Malt Whisky Society Brand Ambassador and Development Manager for Hong Kong and Macau said recently that the number of whisky enthusiasts in China is currently estimated to be between 500,000 and a million. By comparison, twenty years ago, he suggests there were a mere 300 whisky drinkers in the whole country.

As well as the rapidly rising number of Chinese whisky drinkers, it’s the demographic of that drinker that is catching the eye of global marketeers. Whilst in the west, whisky has traditionally been preferred by an older audience, in China it is the young who are drinking more of it. It is estimated that 47% of Chinese whisky drinkers belong to Gen Z (born between 1997 and 2012), and according to a report released by Morgan Stanley, in China, whisky represents more than 50% of the volume consumed by the young urban population below 34 years old (born after 1990) ahead of brandy and baijiu.

Often well-educated and wealthy, these urban youngsters are buying into a lifestyle that represents culture, class and history. Chinese consumers are more adventurous and willing to experiment with new products, brands, and experiences.

The big international whisky brands have realised that the scattergun approach of heavily branding nightclubs and selling cheap whisky to novice punters might have worked a couple of decades ago but is not the primary route any longer. In 2023 the volume of imports rose by 6.4% but their value soared by 23% as buyers look towards premium products.

Whisky is booming among the young in China. It is estimated that 47% of whisky drinkers in the country belong to Gen Z

Actor Chang Chen is the face of Macallan in China

The whisky market developed in Asia “started very much with blends and big brands, trying to do big plays,” said Pedro Mendonça, Global Reserve Managing Director at British drinks company Diageo. “And over the last decade, single malt has taken off, and people are discovering and finding their own way in, and appreciating the different flavours and the different characteristics”.

Chivas Regal was still making up nearly 29% of China’s whisky consumption by volume in 2019 but young Chinese consumers with their own tastes and preferences have driven the rise in popularity of higher value, lower volume products. Single Malt Scotch such as Glenfiddich and the Macallan have tripled and doubled respectively their market share in China since then, according to Euromonitor.

In a bid to educate and engage with China’s first generation of whisky aficionados, Diageo has organised 13 whisky summits across China since 2017 and claims to have reached over 12,000 potential Chinese whisky lovers through a “whisky culture education” institution called Diageo Whisky Academy.

Home grown: The era of the high-tech Chinese distillery

Now that an established audience is emerging, the race is on to create a whisky in China for a Chinese audience. French company Pernod Ricard was the first international spirits company to release a Chinese whisky, made at its own distillery in China’s western Sichuan province. The company said it will invest £110 million over a decade in the project, and when its first release ‘Chuan’ hit the shelves in December 2023 it led to a lot of global headlines.

Pernod Ricard’s The Chuan Pure Malt Whisky from Emeishan - their first China origin whisky

“This first-ever product of The Chuan celebrates the vision of Pernod Ricard to create a prestige malt whisky made in China,” said Jerome Cottin-Bizonne, CEO of Pernod Ricard China in the press release. “We are proud to put China on the world map of whisky by presenting this exceptional malt whisky of The Chuan.”

Diageo have invested over £55 million in their own Eryuan Distillery in the southern Yunnan Province and there are currently around 48 whisky distilleries either in production or under construction in China as local and international players look to diversify their offerings with Chinese origin whisky. Chinese brewery Qingdao Beer and Chinese winery Grace Vineyards both have distilleries in the works, whilst baijiu manufacturers Gaolong and Daiking have diversified into whisky production. Gaolong has been producing a range of Chinese made whiskies for some time and its ‘Gaolong Blended Chinese Whiskey’ and ‘5 Year Old Bourbon Cask Single Malt’ are for sale on the UK-based retail site The Whisky Exchange.

Diageo’s Eryuan Distillery

Cognac company Camus has partnered with baijiu producer Gujinggong to create the £24 million Guqi distillery in Bozhou; and another well-established baijiu producer Yanghe has also moved into whisky making.

Perhaps most astonishing of all has been a major project funded by the MengTai Group that saw the wholesale relocation of stills and equipment shipped in from Scotland by Forsyths to the Ordos region of Inner Mongolia to create a £20 million distillery. The Rothes-based company prefabricated a modular distillery including a two-ton mash tun, copper stills, condensers and stainless steel tanks. This was shipped over to Inner Mongolia, and reassembled with an aim of producing “world-class whisky” after the two years of maturation in casks that the Chinese national standards require. The MengTai Group – like many other Chinese distillery owners, have engaged experienced managers and head distillers from Scotland to lead the project in a bid to ensure quality and authenticity is retained.

Angus Dundee Distillers – makers of Tomintoul and Glencadam among others – has also opened their own distillery near Hangzhou. “We’ve been in China since 2005, and decided China was a market for the future” says Brian Megson, the Director of Angus Dundee Distillers. Megson says that Chun’an Distillery will be finished in two to three years before then requiring a further four to five years to produce whisky.

Megson explains that they had plenty of options when looking for the optimal site. “We wanted to find somewhere that’s not just good for whisky production but also good for the visitor centre. This area is great for tourism, and numbers are mind boggling. Hangzhou is a big city and Shanghai is not far away. We found somewhere that was suitable and found a plot and have had a good amount of support from the local authorities.”

Further south, a large consortium of mainly western investors has opened the Nine Rivers distillery near Xiamen in eastern China. Led by former drinks importer Jay Robertson the project was developed after the cost of importing drinks “went through the roof.”

Robertson explains that Nine Rivers is sustained through crowdfunding. 62% of the investment comes from the board, composed mostly of expats and international investors, and 38% from micro investors, with the entry amount dropping as low as $1,000 USD.

‘The year-round precipitation coupled with summer heat creates the exceptional environment for whisky making that increases the intensity of flavours with more evaporation’

Robertson argues Nine Rivers will become China’s single biggest Single Malt Whisky. “We have had interest from corporate money, engagement from big baijiu companies and one big scotch whisky producer, but we’re not interested in that,” he says. “Our strategy is to have lots of people with skin in the game. China is an influencer- led country. Everything has always been a word-of-mouth culture where recommendations from friends and family trumps advertising spend.”

Nine Rivers Distillery is still under construction but has great ambitions

Robertson says that Nine Rivers aim to make 1.31 million LPA (Litres of Pure Alcohol) at launch, which would be more than the 1 million LPA Pernod Ricard produces from its two-still set up, but less that the four stills that gives Diageo the capacity for 2 million LPA. However, Nine Rivers has the ability to expand up to 7.5 million LPA as and when the demand requires, he argues, which would make it the largest distillery in the country. Furthermore, they plan to launch their own cooperage to help with the lack in supply of barrels in China. The cooperage will make 100,000 barrels a year, of which half will be used by the distillery and the other half sold to other China-based distilleries, says Robertson.

But Nine Rivers is several years behind the Laizhou Distillery in Sichuan which has been filling barrels since 2017. Owned by Bairun – a Chinese company that makes flavourings for the food and drink industry – the distillery is the largest in China by some margin. After finding success with Ready To Drink, cocktail in a can brand Rio, the company struggled to find high-quality, affordable spirits to put into their mixers. They were among the first Chinese company’s to launch a distillery, initially with the concept to contain their own alcohol supply. After a rapid year of research, visits to distilleries around the world, potential site visits and finding suppliers, they have been filling 700 barrels per day and currently have 300,000 barrels of whisky under maturation, says Andy Shen, head of marketing for the company.

A new terroir for a new whisky territory

China’s continental size means that the vastly varying natural environment can influence the flavour of any whisky produced. From the dry plains of Inner Mongolia that is home to the MengTai distillery to the subtropical jungles of Yunnan, where Diageo have their base – the landscape couldn’t be further removed from the rugged mountains of the Scottish Highlands.

“Yunnan Province is renowned for its temperate climate, rich natural biodiversity and pristine water sources”, a Diageo spokesperson tells Barley. “Our distillery in Eryuan County will be carbon neutral and we envision a 100% sustainable approach to malt whisky making that embraces the natural resources and beauty of the region.”

Pernod Ricard’s operation is based in the hot and humid Sichuan province and shares the same water sources on Sichuan’s Mount Emei with Nongfu Spring, China’s leading bottled water brand. “The year-round precipitation coupled with summer heat creates the exceptional environment for whisky making that increases the intensity of flavours with more evaporation,” says a Pernod Ricard spokesperson.

But whisky is not just the sum of its parts. The parts matter a great deal too. Much debate has been had in China whisky circles about whether local barley and grains should be used to produce whisky or whether they have to be imported.

“I believe core whisky consumers expect a Chinese whisky to be ‘Chinese’, which means made entirely in China, from mashing to fermentation to distillation to maturation, all carried out in China,” says Kelvin Tam of the Scotch Malt Whisky Society. “Blending with imported whisky, even if resulting in better whisky, will be considered cheating, hence rejected by at least core consumers.”

According to both Whisky Advocate and Global Drinks Intel, Pernod Ricard’s Chuan whisky includes imported distillate. Pernod Ricard state that: “Chinese ingredients have been fused into high-standard whisky making, such as the use of both European and Chinese barley and the unique mastery of three types of oak from three continents that defines its complexity.”

Diageo says that they “will combine our prestige whisky expertise and craftsmanship with local natural resources to create the finest quality Chinese origin single malt whisky with unique character and provenance. Where possible we will look to optimise local sourcing for the production process.” However, they tell me that they cannot comment at this time on what that means in terms of type and location of grain, mixed or pure Chinese distillate, type of barrels, as the distillery has not yet formally launched. “Our single malt whisky produced in China will have its own unique brand and characteristics,” Diageo says.

Brian Megson of Angus Dundee also tells me that “they have options of both importing barley or using local grains,” in their Chinese distillery. But according to Robertson of Nine Rivers, all barley is imported to China (from US, Australia and Europe) as the Glycosidic nitrile content of Chinese Barley is too high, which can lead to carcinogenic compounds being created in the malting process. “Even the beer in China is made with imported barley,” he claims.

But ultimately how much does it matter? Each territory has its own rules, as Robertson points out. “Australian whisky mostly uses the same wash from the same brewery; the US has many types of whisky – corn whisky, rye whisky, bourbon whisky, Tennessee whisky – with different rules about maturation. Ireland, you have much more flexibility of wood; in India you can call almost anything whisky, Japan has little regulation,” he says. “In China the regulations are similar to Scotch, but it needs two years in a barrel instead of three.”

Robertson says that he wants to differentiate Nine Rivers from Scotch as much as possible. “We are in China, it’s the world’s biggest economy – they are now at the top of the food chain in nearly every single industry. It’s the ones that break out who become world beaters. Why try and get into the slipstream of Scotch? Yes, it’s whisky but there are a lot of things that we can do differently – bringing in terroir, utilising local yeasts and creating our own cooperage.”

Without the strict rules that are imposed on Scotch, whisky made outside of Scotland has the flexibility to use different maltings, waters and casks to create something wholly new.

Wu Hao, the master distiller at the Laizhou distillery, is experimenting with whisky aged in Chinese yellow wine casks. “We season the casks with yellow wine for about 24 months,” he says. “Whisky matured in a Yellow Wine cask is similar in style to a sherry whisky but gives a hint of fermented rice – something that Chinese consumers would be familiar with. When we cook food we always include rice wine so the flavour is very familiar to the Chinese market. It’s a great innovation in that it follows traditional techniques but uses Chinese culture,” he explains.

Laizhou also has its own cooperage and, says Shen, they have been putting whisky into any and every barrel they can get their hands on. “China is a big market with a large population and we don’t know what flavour [whisky] Chinese consumers will love so we want to have all different flavours of casks – bourbon, every type of sherry casks, rum, tequila casks – our objective is to get as many casks as exist in the whisky world to help find what flavours the Chinese consumers will love,” he says.

Not only that but the group has spent years analysing what types of local woods might be used in their production. “Mizunara wood from Japan is a branch of Mongolia oak which originates from China. Mongolian oak is the same as Mizunara but it’s hard and difficult to bend so it has some problems with leakage when used to make whisky, meaning the angel’s share is often as much as 30%” he says.

Laizhou Distillery is currently the largest in China

Laizhou currently uses nearly all English barley but, says Shen, they are experimenting with local grains too. It’s likely local distilleries will experiment with a wide range of grains and processes to find their unique Chinese flavour profile. Shen explains that when the Chinese market determines what that preference is, distilleries will pivot in that direction very quickly.

With a global shortage of wood for barrels to age the distillate, rumour has it that the Chinese baijiu producers that are moving into whisky production, are pushing for oak staves, chips and even powder to be used to flash age whisky. However global institutions including the Scotch Whisky Association have been keeping a close eye on this emerging market, aiming to ensure the existential concept of what a whisky is, does not get too diluted.

“Over several years, the SWA has been working with a variety of stakeholders, including the China National Institute of Food and Fermentation Industries, the Chinese Alcoholic Drinks Association and the Foreign Spirits Producers Association in China to provide input on the revision of the Chinese Whisky Standard,” says Lindesay Low, Deputy Director of Legal Affairs at the SWA.

“The whisky category in China has been built by Scotch Whisky. Now that domestic producers are taking an interest in making whisky, the SWA wants to make sure that so far as possible they follow the same high standards that apply to Scotch, Irish, US Bourbon and other internationally traded whiskies. This is to maintain the category’s premium reputation and to ensure that Chinese consumers, who have become accustomed to this type of whisky, are not short-changed, for example by being sold whisky that has not been aged in wooden barrels,” says Low.

Laizhou Distillery in China

“Places like India and the US have established whisky industries and producers there make their whisky in line with established laws and practices,” Low says. “In China however, where whisky has not been distilled in significant quantities previously, the Chinese authorities were keen to learn from other countries when creating their new standard. Our position was that because Chinese consumers were accustomed to Scotch Whisky, they should follow that definition as closely as possible, taking account of local conditions.”

Rules, regulations and cultural challenges

The aim of both the domestic companies and the global behemoths alike is to create a China origin whisky that will supply the growing domestic market, avoid import regulations, bypass shipping costs and circumnavigate any geopolitical tensions. Not only that, if done well, they might have the potential to be exported globally as the Taiwanese Kavalan and Japanese Nikka whiskies have achieved so successfully.

China might be a vast market, but its unique make-up presents challenges too. Whilst spirit imports rose by 22.8% in 2023, bottled wine imports to China fell 17.6% by value and 29.1% by volume during the same period. This was in no small part due to political conflict between China and Australia and other wine producing regions. On top of this, an oversupply in domestically produced wine and a growing (government-led) nationalistic drive to promote, support and buy domestically – may further complicate the picture. And markets can swing far more rapidly in China than in more established regions. Operating in China for new brands can be daunting with significant obstacles across language, culture, regulatory and intellectual property.

The SWA has been instrumental in keeping whisky import tariffs to just 5% (compared with 10% prior to December 2017) but it’s important for brands looking to enter the Chinese market to be fully aware of the risks — as well as the clear benefits.

Sarah Talland of law firm Potter Clarkson has supported a number of whisky companies entering the Chinese market and is well aware of the potential pitfalls that can arise. “In China there is a first to file trademark system which effectively means someone else can “steal” your brand with little consequence if they file your trademark before you do”, she says. “Therefore, it’s essential to create your own Chinese name, before your customers or third parties do it for you.”

An error many companies make is contacting possible partners in China without obtaining their own IP protection first. “This could result in you being blocked from the market or being forced to work with distributors you would prefer not to, if someone else registers first,” she explains.

Talland tells me that there are many brands that have done this well. Both Glenfiddich and Bruichladdich sensibly ensured they had their trademarks protected and logo copyright in place and took local guidance on suitable Chinese names before they entered the market on a large scale. Now they are both successful whisky brands in China.

With rapidly growing demand and an increased awareness of whisky, sales of both volume and high value whisky are predicted to continue to rise and rise. The investment by some of the big players (and the emergence of newer makers) into producing China origin whisky goes to show the vast untapped potential of whisky in the country. Is China’s market a challenging one? Without doubt. But are the risks worth the seemingly endless rewards? For many, it seems so.

Barley will be co-hosting ‘The China Whisky Outlook 2024’ in partnership with the China-Britain Business Council and the Scotch Whisky Association.

The event will be held in Edinburgh on June 20th 2024 in partnership with Potter Clarkson and cover topics including: How to protect your Scotch Whisky brand in China, how to export your whisky to China, and the Chinese whisky market landscape.

Speakers include Iain Weir (Ian Macleod), Paul Skipworth (Eden Mill St Andrews/SMWS), Sarah Talland (Potter Clarkson), Lindesay Low (SWA), Tom Pattinson (Barley), James Brodie (CBBC) and more to be announced.

The free event is open to businesses in the whisky industry who have entered or plan to enter the Chinese market. To express interest or to register click here or email Tom.Pattinson@barleymagazine.com

Potter Clarkson’s dedicated FMCG team specialise in maximising the value of food and drink brands and products. If you’d like to discuss how they can help you identify, protect, exploit and enforce your ideas and innovations, please contact them at fmcg@potterclarkson.com.